Top Agent Insights: Housing Market Outlook & Predictions for 2026 (HomeLight Report Summary)

After a “freeze” in 2025 driven by affordability pressure, many top agents believe the housing slowdown is easing, and that 2026 will bring more movement on both sides of the transaction. HomeLight’s latest Top Agent Insights report compiles predictions from 859 top-performing real estate agents across the country, capturing what they expect for inventory, pricing, economic conditions, and winning listing strategies. Top-Agents-Insights-Housing-Mar…

What stands out most: the tone is optimistic, but not euphoric. Agents aren’t calling for a sudden boom or a dramatic breakdown. Instead, they describe a market that’s “recalibrating,” where strategy matters more than ever, especially for sellers who want to avoid chasing the market with reductions.

Source: www.homelight.com

Key themes you’ll see throughout this report summary:

• Inventory is expected to loosen

• Prices are projected to keep rising (mostly modestly)

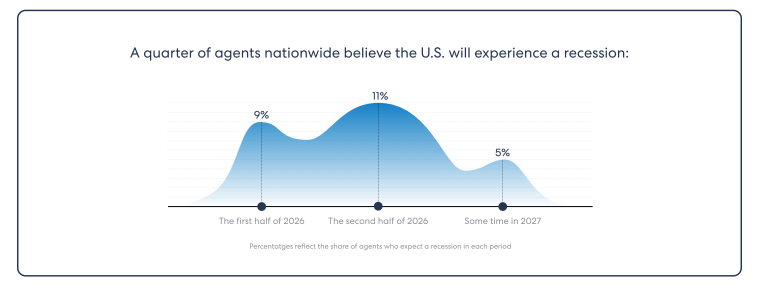

• A recession is considered unlikely by many agents

• Sellers who price slightly below market are winning

• 50-year mortgages may “mask” affordability without fixing it

Snapshot of 2025: high rates, price growth, and a slower pace

To understand 2026 predictions, the report first frames what happened in 2025. Mortgage rates moved around, but remained elevated enough to keep many buyers and sellers on the fence. The report notes the average 30-year fixed rate declined from a 7.04% high in January to around 6.22% in December, yet many consumers still waited for rates to fall further, specifically to 5.75% or less. Top-Agents-Insights-Housing-Mar…

Meanwhile, affordability stayed tight as prices continued rising year-over-year. The report states the median home price posted 29 consecutive months of year-over-year increases. Market conditions reflected that tension: homes took longer to sell, and price reductions were common.

Here’s the 2025 texture from agents:

• Average days on market: 84

• Listings with price reductions: 39%

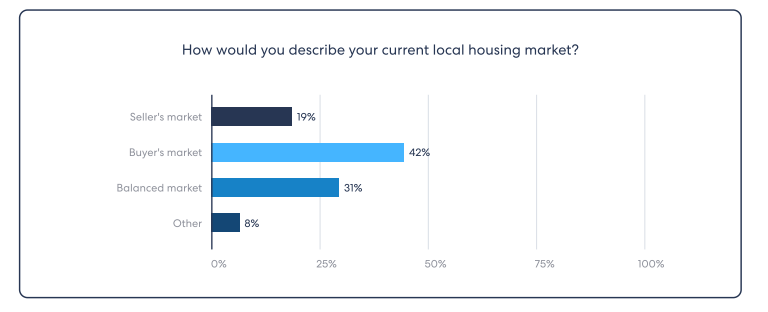

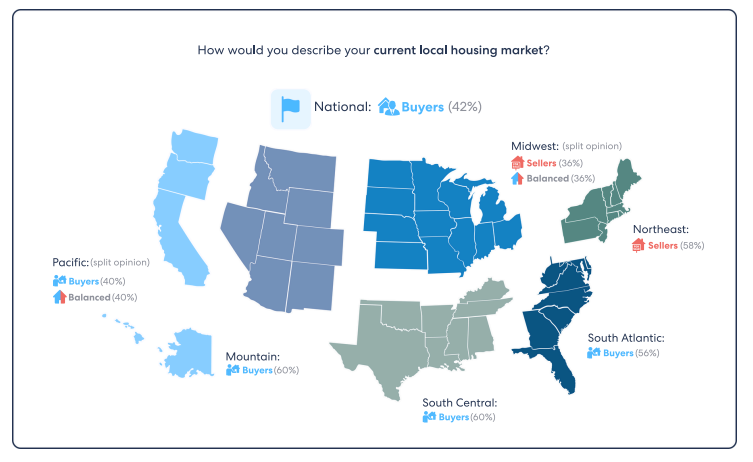

• Agents describing their market as: buyer’s market (42%), balanced (31%), seller’s market (19%)

A notable regional exception: the Northeast leaned far more seller-friendly, with 58% of top agents in that region calling it a seller’s market.

Source: www.homelight.com

2026 inventory forecast: more listings should hit the market

One of the biggest predictions for 2026 is that inventory will finally loosen, not because demand disappears, but because more sellers are expected to re-enter the market. Agents anticipate that “wait-and-see” homeowners will get tired of postponing life plans and may list as rates become more tolerable.

According to the report:

• 70% of agents are optimistic about the 2026 housing market (with 22% “extremely optimistic”)

• 68% of agents expect housing inventory to increase in 2026 Top-Agents-Insights-Housing-Mar…

This is an important nuance: “more inventory” doesn’t automatically mean “cheap homes.” It more likely signals improved selection, slightly less desperation, and better conditions for buyers who felt boxed out by ultra-tight supply.

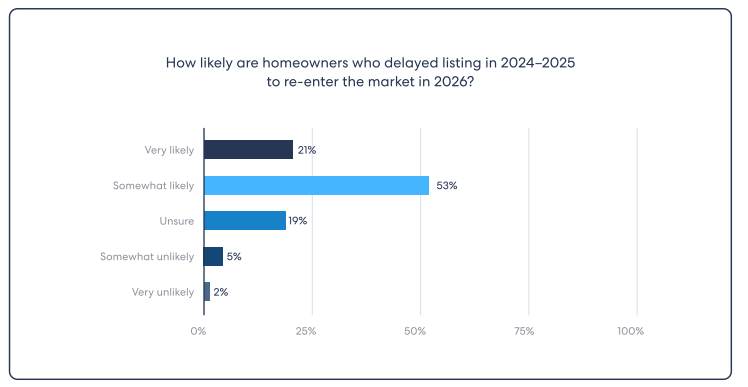

Agents also believe many delayed sellers will return: the report says 74% (combined) believe it’s likely homeowners who postponed selling in recent years will re-enter the market.

Source: www.homelight.com

2026 home price predictions: most agents still expect upward movement

Even with more homes expected to come to market, agents still predict prices will rise overall in 2026, just not at the blistering pace seen during the pandemic-era surge.

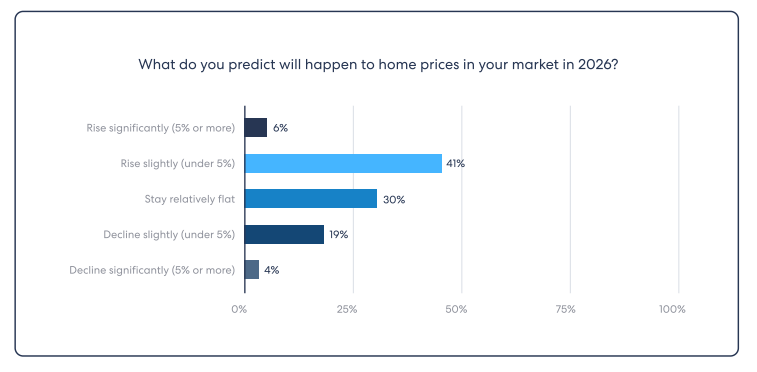

The distribution in the report is telling:

• 41% predict price increases under 5%

• 6% predict prices up more than 5%

• 30% expect prices to be relatively flat

• 19% anticipate a slight decrease

• 4% expect prices to decline significantly

So while there’s a range of outcomes depending on local market conditions, the center of gravity remains: modest appreciation is still the base case.

For buyers waiting on a “perfect” moment, the report includes a practical reminder repeated often by agents: if rates drop later, refinancing may be an option, but waiting can also mean paying more for the home itself.

Source: www.homelight.com

Economic outlook: slow growth, but recession fears appear muted

On the economy, many surveyed agents push back on “doom” narratives. The report finds:

• 47% of agents predict slow economic growth in 2026, but no recession Top-Agents-Insights-Housing-Mar…

• Another 20% believe the economy will strengthen in 2026 Top-Agents-Insights-Housing-Mar…

The message from agents is essentially: this is a reset and a normalization, not a collapse. That doesn’t mean affordability pressures go away (they don’t), but it does suggest agents expect steadier footing rather than a downturn-driven shock.

Source: www.homelight.com

Get Your Home Sold

for Top Dollar, Today!

With over 750+ homes sold and 300+ 5-star reviews, The Finigan Group delivers the results others promise — and gets you Top Dollar without the stress.

- HGTV Videos: Cinematic listing tour videos that sell the lifestyle

- Aggressive Marketing: $33k/month marketing machine promoting your home

- White-Glove Service: Every detail handled, every showing maximized

Don’t take our word for it

See what our clients say:

We’re Social! Lets Connect:

Table of Contents

Introduction: What Top Agents Predict for 2026

Key Takeaways

How 2025 Set the Stage: Rates, Prices, and Market Conditions

Inventory in 2026: Why More Sellers May List

Home Prices in 2026: Upward Trend, Slower Pace

Economic Outlook: Slow Growth, Recession Unlikely

What Selling a Home Will Look Like in 2026

Pricing Strategy That’s Winning Listings: Slightly Below Market

The 8 Seller Strategy Shifts Agents Recommend

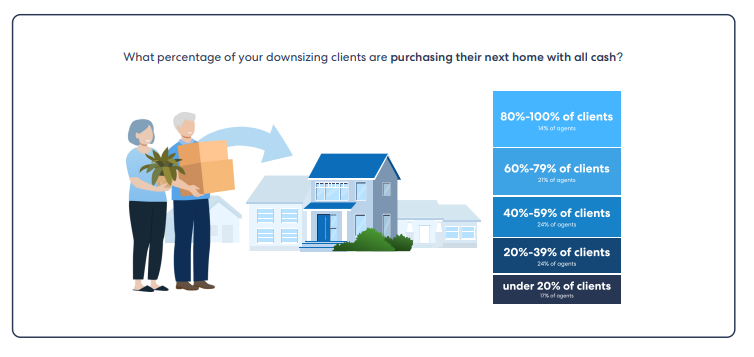

Buyer Trends: Cash Downsizers and “Buy Before You Sell” Programs

50-Year Mortgages: Affordability Help or Hidden Cost?

Top Buyer & Seller Fears Heading Into 2026

What selling a home will look like in 2026: strategy beats “hope”

If there’s one section sellers should read twice, it’s the selling strategy guidance. The report notes agents are split on tactics like open houses; only 30% say open houses are always part of their listing strategy. Top-Agents-Insights-Housing-Mar…

But on pricing and execution, the consensus is stronger:

• It takes an average of 14 showings to sell a house (nationwide)

• 57% of agents say the best strategy is pricing slightly below market to drive offers

• 34% recommend pricing at market value

• Only 5% suggest pricing slightly above market

Even more important: agents say pricing accuracy will heavily influence speed. The report states 62% believe accurate pricing will be the #1 factor impacting how quickly a home sells in 2026 (versus 23% who chose condition).

Translation: in 2026, you can still win, but you win with precision, not wishful thinking.

Source: www.homelight.com

The 8 strategic shifts sellers should make in 2026

HomeLight summarizes eight seller shifts agents believe will matter most. These align with what we’re seeing in many markets: buyers are more selective, presentation matters, and the first two weeks are critical. The report lists the following recommended shifts:

• Price to win quickly by listing slightly below market to create urgency

• Reduce buyer risk with a pre-listing inspection + transparent documentation

• Make the home feel turnkey: declutter, handle deferred maintenance, and focus on high-impact cosmetic fixes

• Treat the first 10–14 days as make-or-break; monitor feedback and adjust fast

• “Launch before you list” with coming-soon marketing and targeted outreach

• Sell the lifestyle with listing copy that explains how the home lives (not just features)

• Hire an agent for modern strategy and hands-on execution (not familiarity alone)

• Use smart incentives (rate buydowns/closing cost help) instead of defaulting to price cuts.

If you’re a seller planning for 2026, these points form a clear playbook: strong launch, strong presentation, and a pricing strategy that creates momentum early.

Source: www.homelight.com

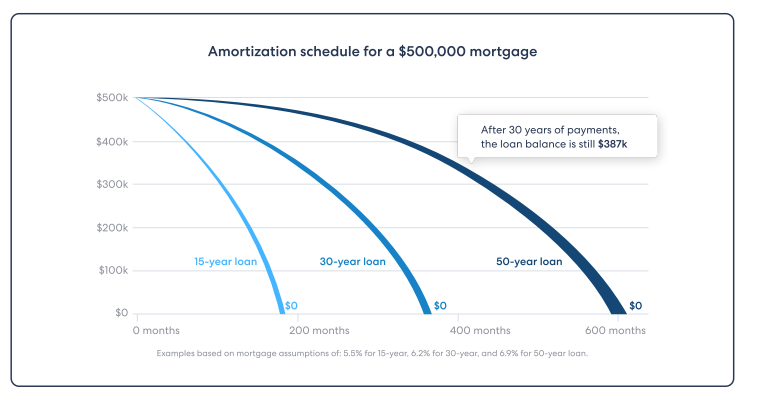

Affordability and 50-year mortgages: “a tool, not a fix”

The report also highlights a growing conversation: longer-term mortgage products, including 50-year mortgages. Agents caution that these loans may lower monthly payments, but can increase long-run costs and slow equity growth.

Key points the report calls out:

• Agents warn 50-year loans can create an “illusion of affordability” while increasing long-term interest costs and slowing equity buildup, especially early in the loan.

• In one example discussed, the buyer might save about $180/month, but pay about $612,000 more in interest over the life of the loan.

• 52% of agents predict a 50-year mortgage could increase buyer demand (14% expect a significant increase)

• Yet most don’t expect widespread adoption: 43% think only a small minority would use it, and 23% predict very few or none would choose it.

• 88% predict the primary users would be first-time buyers struggling with affordability.

Bottom line: Agents view 50-year mortgages as a possible bridge for some buyers, but a risky long-term solution if used without a refinance plan.

Source: www.homelight.com

Biggest fears heading into 2026: sellers worry about proceeds, buyers worry about payments

Finally, the report captures emotional reality: both sides are still anxious, just about different things. The summary is clear:

• Top seller fear: selling for less than peak price

• Top buyer fear: affording the home and monthly payments

This is exactly why 2026 is shaping up as a “communication and strategy” market. The agents quoted in the report emphasize that knowledgeable guidance, and fast, data-driven adjustments, will separate smooth transactions from missed opportunities.

Source: www.homelight.com

Final take: 2026 is shaping up as a year of movement and strategy

Taken together, HomeLight’s Top Agent Insights point to a housing market that’s not collapsing or surging, but adjusting. Inventory may rise as more sellers re-enter, prices are still expected to trend upward (mostly modestly), and recession expectations appear relatively low among surveyed agents.

If you’re planning to buy or sell in 2026, the headline isn’t “wait for perfection.” It’s “prepare for reality”, with pricing precision, strong marketing, and a financing plan that doesn’t confuse lower monthly payments with true affordability.

Thinking about buying or selling in 2026? The right strategy will matter more than ever, especially pricing, presentation, and negotiation. If you want a plan tailored to your neighborhood and timeline, reach out and let’s map out your best next move.

Let’s Connect Today!

Phone:

704-200-9833

Email:

info@thefinigangroup.com

Visit Us:

3440 Toringdon Way, ste 205

Charlotte NC 28277

(704) 200-9833

(704) 200-9833

info@thefinigangroup.com

info@thefinigangroup.com

![How Much Is My Home Worth? [The Ultimate Guide]](https://images.squarespace-cdn.com/content/v1/67d2b38acae1897849b8377a/1743982794751-FX0FEX4DKW6R49RZ2EIK/B7e8JvhOVm4-HD.jpg)